Contribute to Building Resilience: Empower Our Community Today

Your generosity drives this bold vision forward. Together, we’re building a future with greater capacity to meet every critical need in our community.

Because TCAA is a 501(c)3 nonprofit organization and an Arizona Qualifying Charitable Organization, your donation may be tax deductible and eligible for a dollar-for-dollar Arizona state. For more information about your eligibility and how to claim the deduction and/or tax credit, please consult a tax professional.

EIN/Tax ID#: 86-0254820 | QCO code: 20304

Have you thought about donating appreciated stock/securities to reduce capital gains tax?

When donating to TCAA, you may take a tax deduction for the "full fair market" value, avoiding capital gains tax, without paying more out of pocket (please consult your tax advisor). Click here for the instructions on how to donate appreciated stocks/securities.

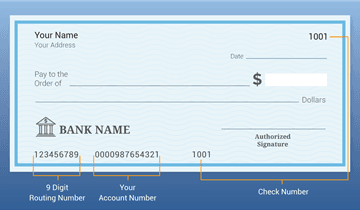

For Banking Account (ACH) option, must enter routing and account numbers. See image below.